The 5-Second Trick For Hard Money Georgia

Wiki Article

Excitement About Hard Money Georgia

Table of ContentsThe Facts About Hard Money Georgia RevealedWhat Does Hard Money Georgia Mean?Hard Money Georgia Things To Know Before You BuyGetting The Hard Money Georgia To Work

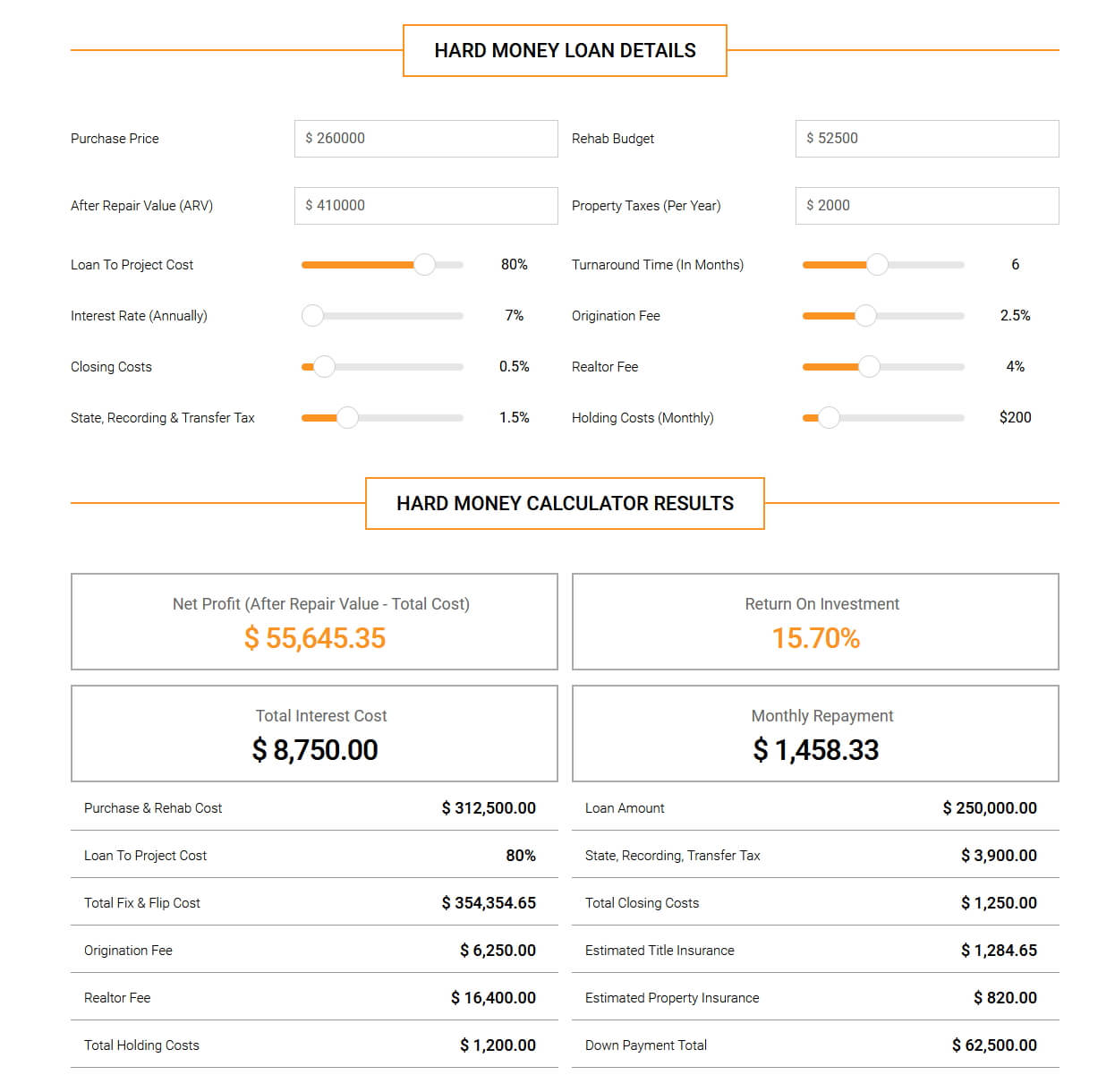

The maximum appropriate LTV for a tough cash lending is usually 65% to 75%. That's exactly how much of the property's price the lending institution will certainly agree to cover. For instance, on a $200,000 house, the maximum a difficult money lender would certainly want to provide you is $150,000. To purchase the building, you'll need to develop a down settlement huge sufficient to cover the rest of the acquisition cost.

By contrast, interest prices on hard cash lendings start at 6. Tough cash lending institutions typically charge points on your finance, sometimes referred to as source costs.

Points are typically 2% to 3% of the financing quantity. Three points on a $200,000 finance would be 3%, or $6,000.

The Definitive Guide for Hard Money Georgia

You can anticipate to pay anywhere from $500 to $2,500 in underwriting costs. Some hard cash lenders also charge early repayment fines, as they make their cash off the passion fees you pay them. That indicates if you repay the funding early, you might have to pay an additional fee, including to the loan's expense.This means you're most likely to be provided funding than if you made an application for a standard home mortgage with a questionable or thin credit scores background. If you require cash promptly for restorations to flip a residence for revenue, a tough money loan can provide you the money you need without the inconvenience and also paperwork of a traditional home mortgage.

It's an approach financiers make use of to acquire investments such as rental homes without utilizing a lot of their own assets, as well as hard cash can be useful in these circumstances. Difficult money car loans can be helpful for genuine estate investors, they ought to be used with caution especially if you're a novice to genuine estate investing.

With shorter settlement terms, your month-to-month settlements will be even more expensive than with a regular home loan. If you skip on your finance payments with a tough cash loan provider, the repercussions can be severe. Some lendings are directly assured so it can harm your debt. As well this hyperlink as due to the fact that the car loan is protected by the residential or commercial property in inquiry, the loan provider can occupy as well as seize on the property because it acts as security.

Examine This Report on Hard Money Georgia

To discover a respectable loan provider, speak with trusted property agents or home mortgage brokers. They might be able to refer you to lenders they've dealt with in the past. Difficult cash lenders additionally commonly attend actual estate investor conferences to ensure that can be a good area to get in touch with lending institutions near you.Equity is the worth of the residential property minus what you still owe on the home loan. Like tough cash finances, residence equity lendings are secured financial obligation, which indicates your building functions as collateral. Nonetheless, the underwriting for residence equity fundings also takes your credit rating history as well as earnings right into account so they have a tendency to have lower rates of interest and also longer settlement periods.

When it concerns moneying their next bargain, genuine estate capitalists and also business owners are privy to numerous lending options basically made for property. Each includes specific requirements to accessibility, and also if made use of correctly, can be of significant advantage to capitalists. Among these lending kinds is hard money lending.

It can additionally be called an asset-based finance or a STABBL finance (short-term asset-backed swing loan) or a bridge loan. These are stemmed from its particular temporary nature and the requirement for tangible, physical collateral, generally in the type of real estate residential property. A difficult money funding is a car loan type that is backed by or secured utilizing a genuine property.

Top Guidelines Of Hard Money Georgia

In the same blood vessel, the non-conforming nature pays for the lending institutions a possibility to choose their own certain needs. Consequently, demands might vary substantially from lending institution to lender. If you are seeking a financing for the very first time, the authorization procedure can be relatively strict and also you might be required to offer extra info.

This is why they are mainly accessed by realty entrepreneurs who would commonly require rapid funding in order to not miss out on out on warm possibilities. Furthermore, the click here for more info lending institution mostly takes into consideration the worth of the property or property to be purchased as opposed to the consumer's individual money background such as credit history or earnings.

A traditional or small business loan may occupy to 45 days to shut while a difficult money lending can be enclosed 7 to 10 days, occasionally faster. The comfort and rate that tough money car loans offer continue to be a significant driving force for why actual estate capitalists select to use them.

Report this wiki page